PDF editing your way

Complete or edit your 2018 1099 misc form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2018 1099 misc fillable pdf directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your amazon as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 1099 misc 2018 pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Printable 1099 Form

- Copy A must be filed with the Internal Revenue Service Center

- Form 1099-MISC requires recipient's name, TIN, payer's TIN, and payment details

- Certain sections of the form relate to income tax withholding and direct sales

Award-winning PDF software

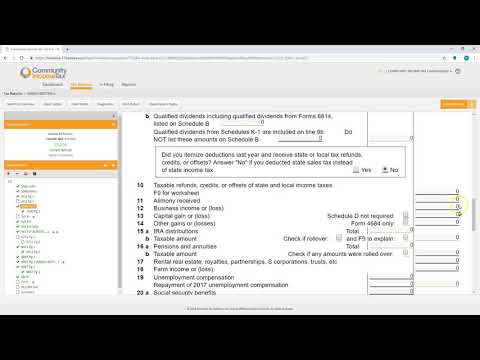

How to prepare Printable 1099 Form

About 1099 MISC 2018

Form 1099-MISC is an Internal Revenue Service (IRS) tax form used to report miscellaneous income received for services provided by an individual or a business to another party during the year. The form specifies the amount paid to the recipient and is typically used to report non-employee income. As for who needs it, the payer or business that made payments of $600 or more to an individual or a business during the tax year is required to issue a Form 1099-MISC to the recipient and file a copy with the IRS. Some common scenarios where a Form 1099-MISC may be necessary include: 1. Freelancers or independent contractors who provided services to a business. 2. Individuals who received rental income from a property. 3. Individuals who received royalties or other income from intellectual property. 4. Non-employee compensation paid to self-employed individuals or subcontractors. 5. Prizes and awards exceeding $600 in value. 6. Payments made to attorneys, including legal settlements. It is important to note that the rules for Form 1099-MISC can vary depending on the specific circumstances, so it is advisable to consult the IRS guidelines or seek professional tax advice to ensure compliance with reporting requirements.

How to complete a Printable 1099 Form

- Make sure to enter the required information accurately, including recipient's TIN, payer's TIN, recipient's name, payer's name, address, and other income details

- Refer to the 2018 Instructions for Form 1099MISC if needed

- Once all the information is filled out, you can file the form with the recipient's state income tax return if required

People also ask about Printable 1099 Form

What people say about us

The expanding need for digital forms

Video instructions and help with filling out and completing Printable 1099 Form